when will capital gains tax increase take effect

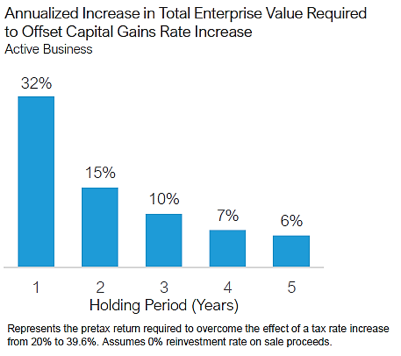

It means that when capital gains taxes most assuredly will increase from the current maximum 20 to 396 in 2022 under the Biden administrations plan you will be. The capital gains tax on most net gains is no more than 15 for most people.

Biden Capital Gains Tax Plan Could Raise 113 Billion If Step Up Is Killed

Make investments in Isas as any gains are tax.

. The rate at which you pay Income Tax denotes which rate you pay for Capital Gains Tax. Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic. Massachusetts voters approved a 4 tax on annual income above 1 million on top of the states current 5 flat income tax.

While the current top capital gains rate is 20 the proposal will subject investors above the previously mentioned benchmark to a tax rate in line with the top income tax rate of. If the effective date is retroactive. You can use investment capital losses to offset gains.

Effect of Capital Gains Tax Increase. For example if you sold a stock. Increase the Top Income Tax Rate.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. Should Bidens new capital gains provisions take effect in 2022 your total tax would be increased by over 300000. First published on Sun 6 Nov 2022 1326 EST.

Yesterday Bloomberg reported that the Biden administration is considering raising the top statutory marginal tax rate on long term capital gains and qualified. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0.

2 days agoKey Points. Jeremy Hunt will set out tax rises and spending cuts totalling 60bn at the autumn statement under current plans including at. Effective in 2023 the new levy aims to.

The top rate would jump to 396 from 20. Weve got all the 2021 and 2022 capital gains. In 2021 the estate and gift tax exemption of 117 million 234 million for married couples will still allow your clients to pass on up to that amount before paying any.

The act also eliminated the preferential treatment of capital gains though it established a maximum rate on long-term capital gains of 28 suggesting the possibility that Congress. President Biden will propose a capital gains tax increase for households making more than 1 million per year. The new tax plan proposes a.

President Bidens tax plan proposes a number of changes to capital gains tax that could have a major impact. The gains that you make from the selling of your capital assets which you held for at least one year will be considered long-term gains and these can be taxed at anything from. Reduce your taxable income.

For example if you sell stock A for a 10000 profit in 2022 be prepared to pay when you file in 2023. In this case it might be worth it to elect out of. A blog on the Cap X site says that whenever politicians are casting around for taxes to increase one hoary old chestnut is the desire to increase CGT to the same rate as.

Bidens budget assumes the BBBA increases take effect and would pile on another 25 trillion of tax increases 16 trillion from corporate and international tax changes 780.

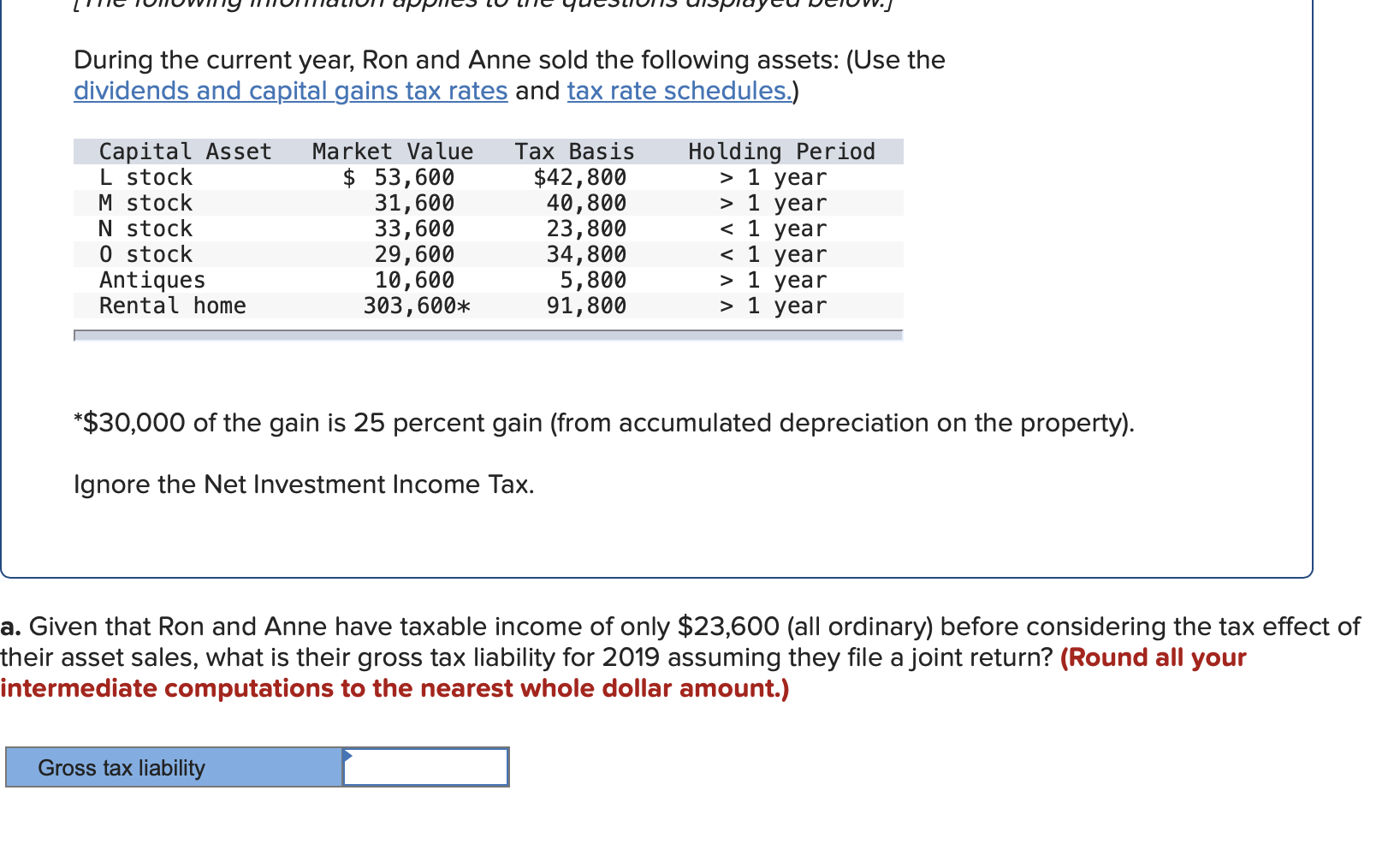

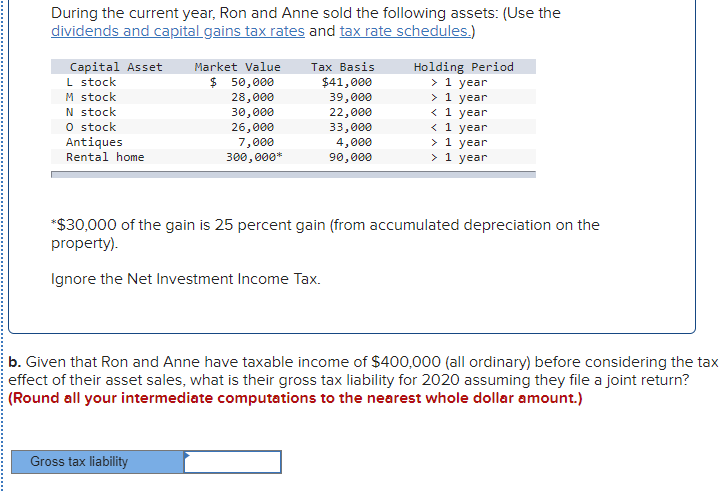

During The Current Year Ron And Anne Sold The Chegg Com

Capital Gains Tax Minimum Wage Increase Among New Laws Taking Effect In 2022 Mynorthwest Com

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Capital Gains Tax In The United States Wikipedia

Capital Gains Tax What Is It When Do You Pay It

How Does The Capital Gains Tax Work By Kevin Martini

In Case Of Capital Gains Tax Hike Don T Panic Thinkadvisor

Capital Gains Taxes For Crypto And Stocks How Do They Work Domain Money

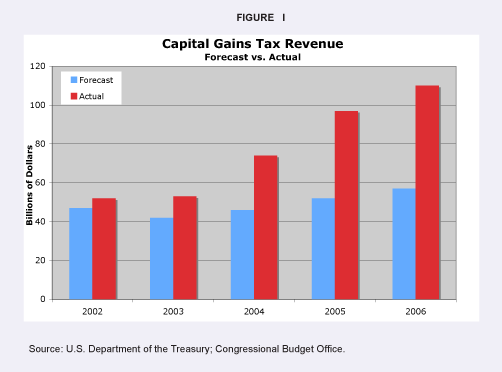

Some Effects Of The 2003 Capital Gains Tax Rate Cut

Capital Gains Tax In The United States Wikipedia

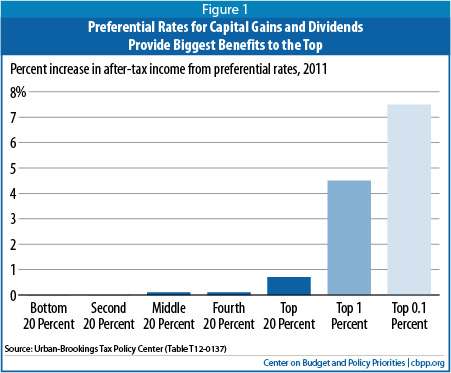

Raising Today S Low Capital Gains Tax Rates Could Promote Economic Efficiency And Fairness While Helping Reduce Deficits Center On Budget And Policy Priorities

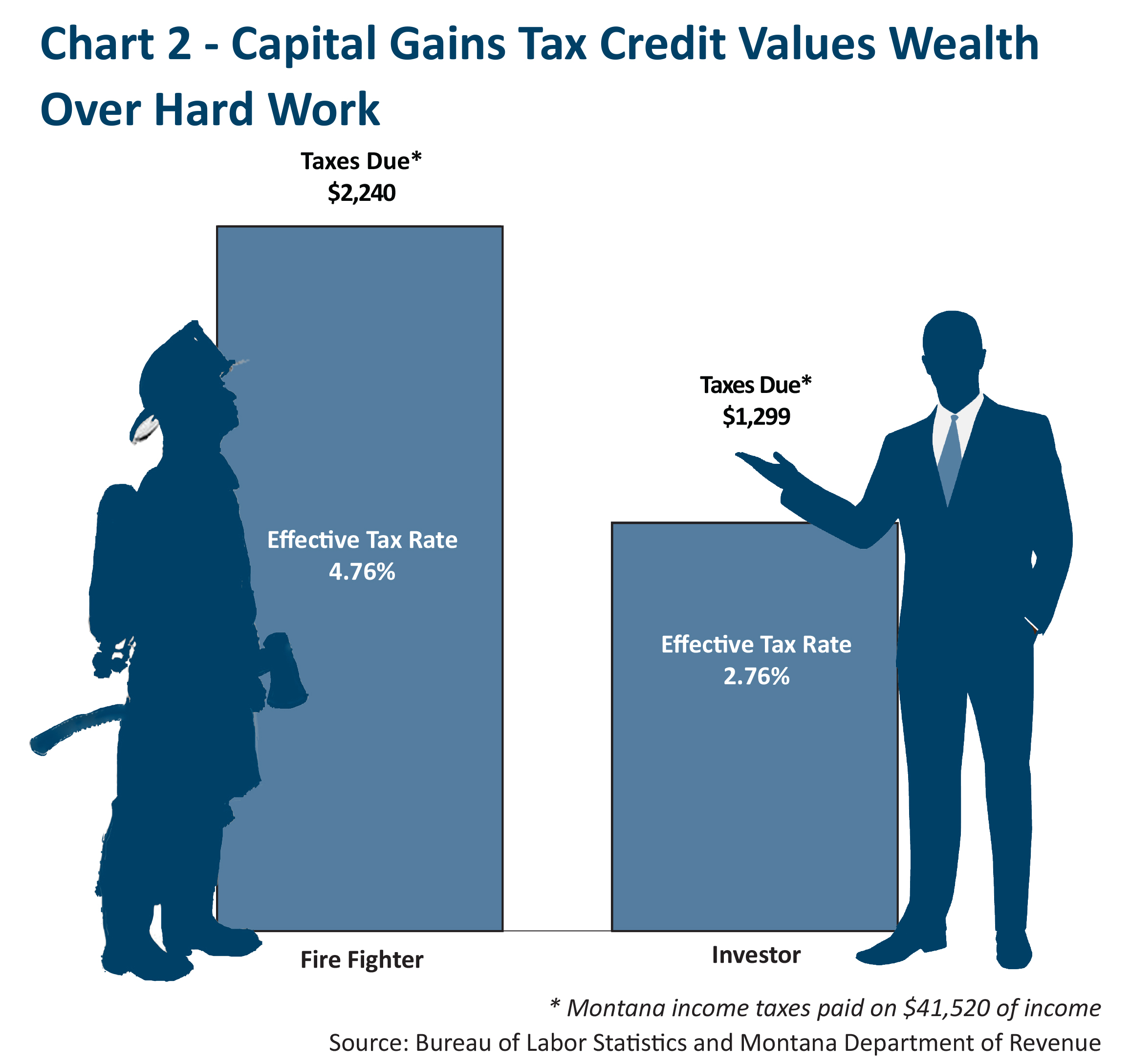

The Montana We Could Be Tax Cuts Aimed At The Rich Take A Toll Montana Budget Policy Center

House Democrats Propose Hiking Capital Gains Tax To 28 8

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Capital Gains Tax Real Estate Home Sales Rocket Mortgage

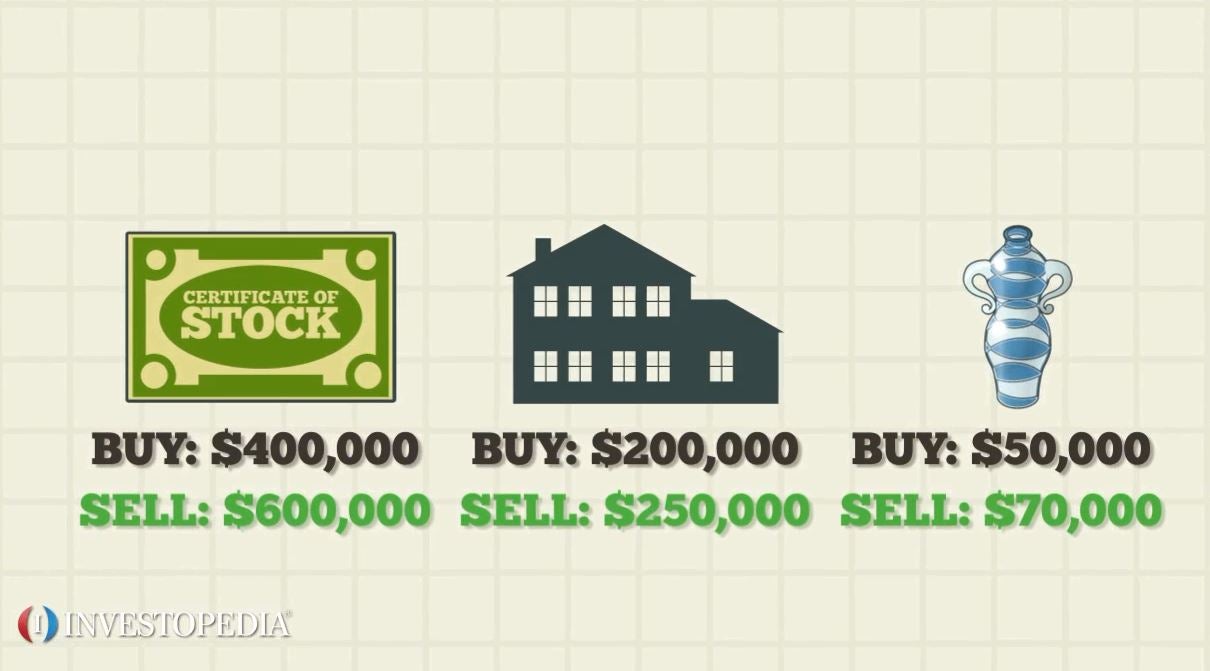

Capital Gains Definition Rules Taxes And Asset Types

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

Solved During The Current Year Ron And Anne Sold The Chegg Com

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy